According to Bloomberg News, Blackstone Group has advised its investors to “dial back their expectations” regarding future return rates on real estate assets. Chris Heady, Asia Pacific Chairman, reasoned that expectations should be managed because the the return rates previously achieved over the last 5 years will become “harder to replicate.”

However.

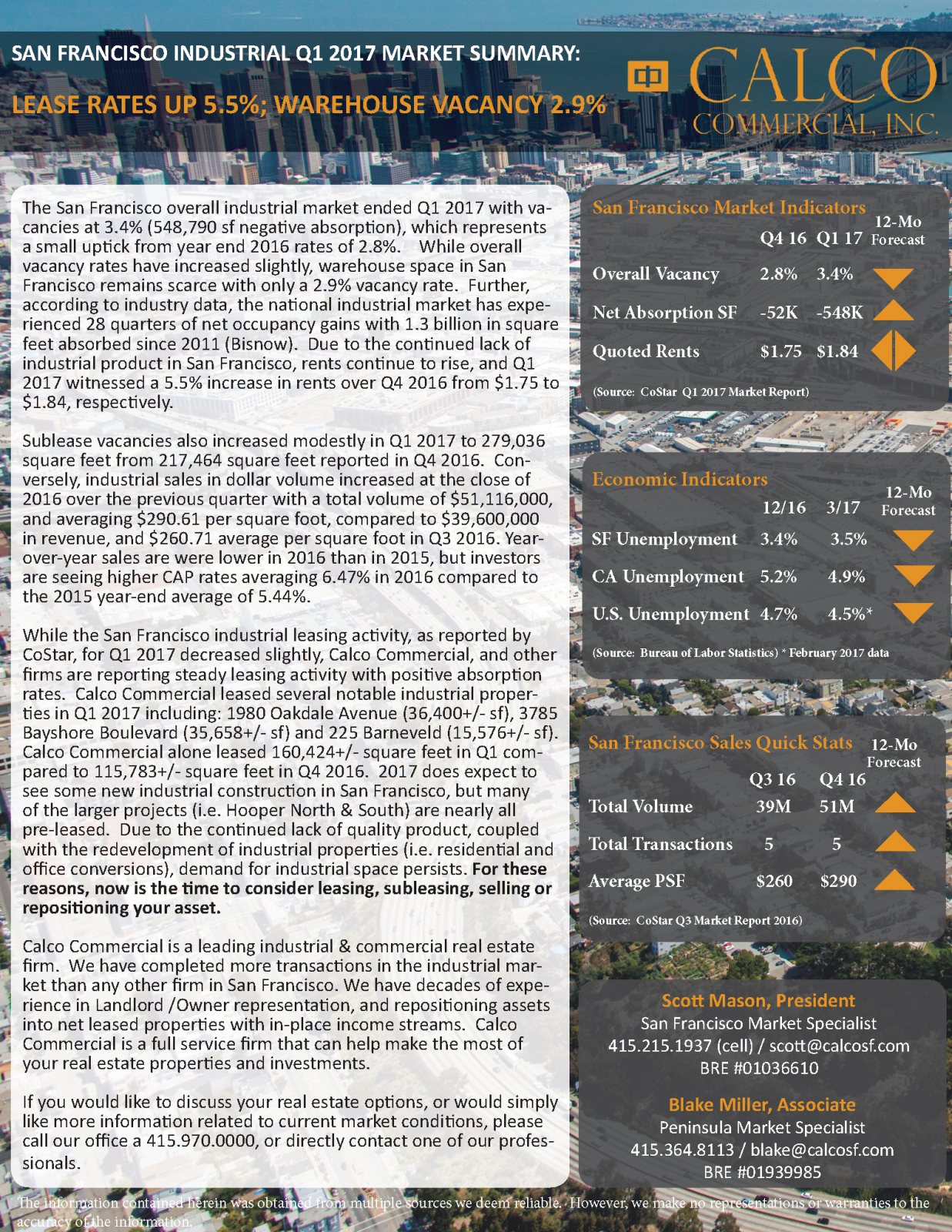

According to Bisnow, other commercial real estate industry leaders aren’t shouting “bubble” just yet. “Reis economist Victor Calanog said in March the industry still has room to grow,” and that market deceleration is “not on a national level.” Even markets such as San Francisco where rents have consistently climbed quarter over quarter, Calanog predicts Landlords will have to offer more “concessions” but that concessions do not equate to “burst bubbles.”