Click here for the full Q2 2018 Report: Mid-Year Market Report 2018

Click here for the full Q2 2018 Report: Mid-Year Market Report 2018

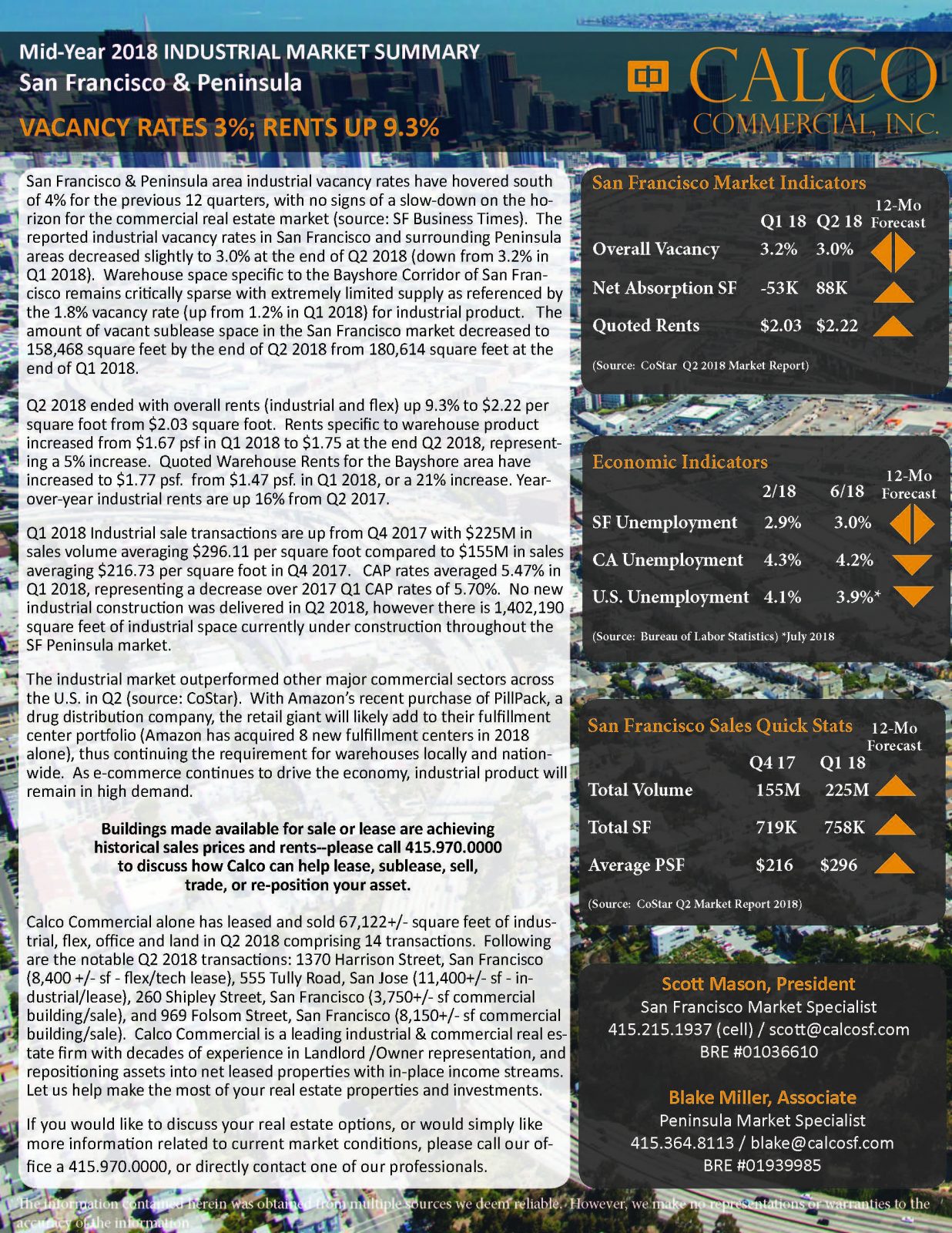

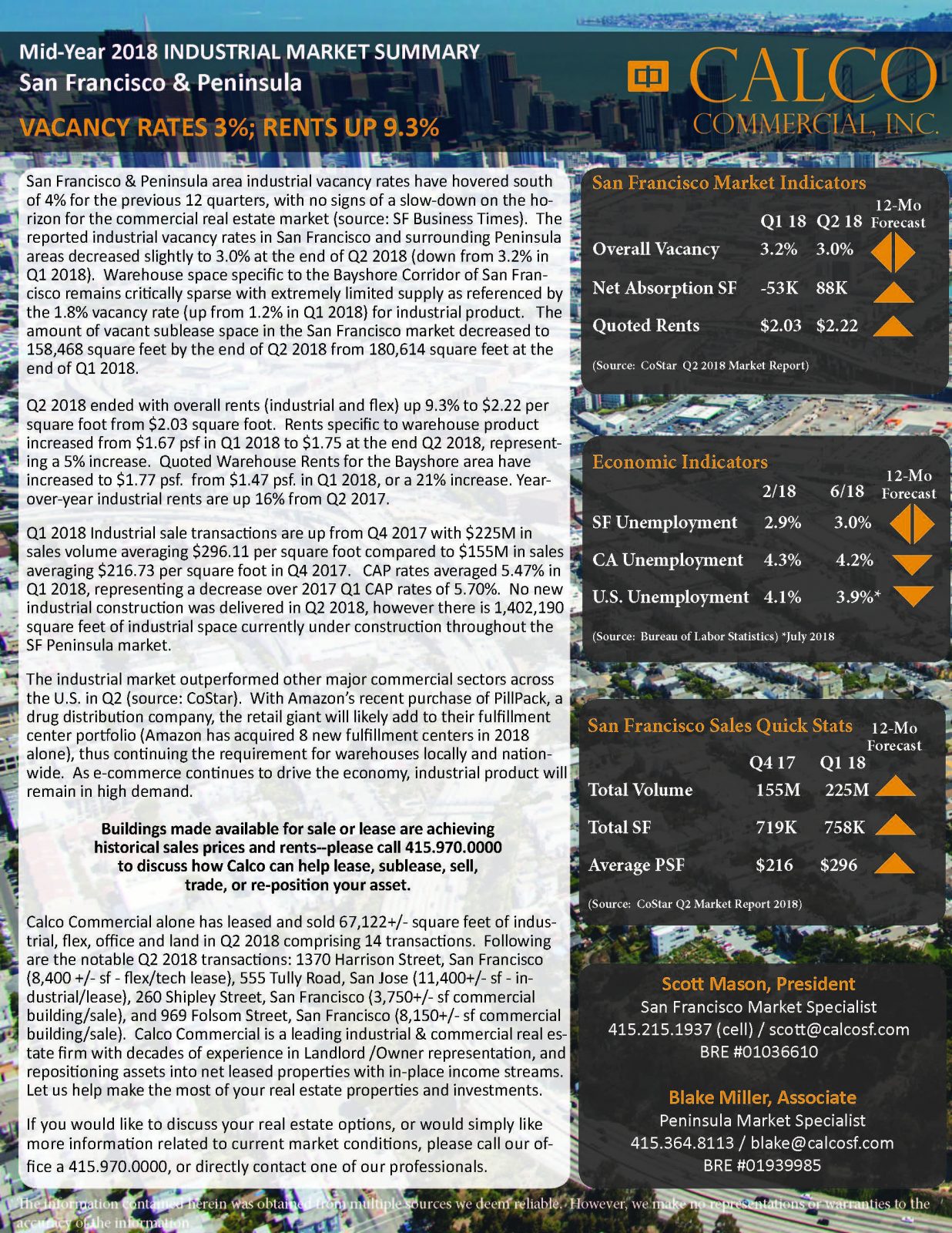

Amazon’s pending purchase of online pharmacy PillPack has the potential to create a need for specialized warehouse space to ship prescription drugs and even lead to small retail clinics, adding demand to an already surging industrial property market.

The move by the online retailer could have significant implications for industrial property sales, which outperformed other major commercial sectors across the U.S. in the second quarter as Amazon and other companies pump up their supply chains for e-commerce delivery, according to CoStar data.

“If you really read between the lines here, and kind of analyze this, Amazon wants to be part of every single transaction that happens in our lives,” said Gregory Healy, senior vice president of chain and logistics at Colliers International.

Amazon, the world’s largest retailer, bought PillPack in late June for an estimated $1 billion. PillPack holds pharmacy licenses in all 50 states and ships medications from its primary drug distribution center in Manchester, NH, to customers who take multiple daily prescriptions. The company is targeting a major market: On its website, PillPack says 40 million adults take more than five prescriptions each day.

If Amazon incorporates PillPack’s approximately 1 million customers into its Prime membership business, which has 100 million subscribers, the company would need drug distribution centers near large cities cleared to handle medicines, said Santo Leo, founder and CEO of MailMyPrescriptions.com in Boca Raton, FL.

Those could be small centers dotted across the country or a handful of larger ones. In either case, they will have to meet far more specialized state and federal requirements because the goods being handled are medicine, Leo said.

Though Amazon already owns or leases about 100 million square feet of distribution space, “you can’t just rip a warehouse out and put a pharmacy there,” said Leo, whose mail-order pharmacy is licensed to dispense prescription drugs in more than 40 states. “You need to design these from scratch. You need more power, more data, more security measures. Traditional big, bulky, automated facilities are just not designed for pharmaceuticals.”

Pharmaceutical warehouses must have processes in place for temperature control, security, documentation and the ability to address product recalls, said Carmine Catizone, executive director of the National Association of Boards of Pharmacy, which accredits wholesale pharmaceutical warehouses. Each state also has different licensing requirements.

The company may need new buildings for an online pharmacy, the analysts said. Though Amazon is opening fulfillment centers at a dizzying rate — eight so far in 2018 — it has a host of controls to ensure each center operates at maximum capacity and has little extra space, the company said in its 2017 annual report.

Amazon declined to comment on its plans for specialized PillPack warehouse space. Amazon hasn’t made any public statements about its PillPack strategy since shortly after the purchase, which is expected to close by the end of the year.

Amazon’s PillPack purchase follows its joint venture with Berkshire Hathaway Inc. and JPMorgan Chase to improve the U.S. health care system and cut costs. PillPack is part of that strategy, said Leo, who predicted Amazon would move quickly to grow PillPack to place pressure on health-care competitors.

“How do you keep people out of the doctor’s office or hospital lab? Make sure people take their prescriptions,” he said.

Healy said the purchase could have implications for any brick-and-mortar plans Amazon has as well, noting the trend toward small, walk-in clinics across the country. It’s estimated there are now almost 3,000 such clinics, according to Accenture. He also speculated that Amazon could add pharmacy services to its Whole Foods stores.

“It will probably net a greater industrial space for Amazon, but I would think there would be some sort of new retail model,” he said. “There could be something else down the pipeline, perhaps a new form of retail.”

Source: CoStar News

By: Rob Smith

Date: August 2, 2018

Link: Amazon

Source: San Francisco Chronicle

By: Roland Li

Date: July 26, 2018

Facebook’s recent share plunge was one for the stock-books as the $119 billion decrease officially became the largest drop on Wall Street, even surpassing Intel’s $90 billion one-day drop in 2000. Facebook is one of the Bay Area’s largest employers and drives a local economies–what does this severe decrease in stock value mean for the Bay? According to the The Chronicle, the plunge will not “hurt the Bay Area economy.” Coupled with their “$42.3 billion cash reserve,” and with a planned 20,000+/- jobs being added to the security team, Facebook will continue to “boost the local economy.”

Other economists worry that the drop in price could indicate a pending correction in the market. However, with Amazon’s massive increase in Q2 earnings, it may be too early to predict if Facebook is suffering from an overall market dip, or its own public relation woes.

According to Gary Schlossberg, a senior economist at Wells Fargo and quoted in the Chronicle article, the market has experienced a “mild deterioration in some of the fundamentals driving the market. The question is: how much will U.S. growth slow and with it earnings growth? A lot of strength in earnings has to do with corporate tax cuts. We need to see how aggressively the Fed will move interest rates. There could be a gradual turn toward ad less friendly environment for the stock market.”

Time will tell.

Source: CoStar News

By: Mark Heschemeyer

Date: July 19, 2018

Link: Distressed

The deal announced this week that private equity firm Stone Point Capital plans to buy Sabal Capital Partners, a small-balance, multifamily lender and loan servicer, is only the latest maneuvering in the shifting landscape for special servicing of commercial real estate loans. More deals are likely as a projected rise in interest rates may boost distress in the market.

Special servicers control the fate of billions in distressed loans and thus the fate of billions in commercial properties. And right now, that is a lucrative market flooded with capital but with fewer investment opportunities capable of providing the higher returns expected from private equity investors.

The jockeying for position is not only indicative of billions of private equity money flowing into distressed assets but also shows where the market is heading.

Driven in part by retail weakness, the volume of loans in commercial mortgage bonds on servicers’ “watch lists” has been on a gradual upswing since last November, according to Morningstar Credit Ratings data. Loans are put on a watch list because of issues such as declining occupancy or net incomes at the properties backing the loans. The rise in volume is considered a reliable indicator of future distress.

The maneuvering is not done, with a prize still to be had. One of the three largest commercial loan special servicers in the market, Rialto Capital Advisors, is still in play. Its owner, homebuilder Lennar Corp., has hired financial advisers to determine Rialto’s strategic alternatives as Lennar shifts to concentrating purely on residential building.

Three of Rialto’s larger competitors are owned by bank holding companies, PNC Financial Services Group owns Midland Loan Services, the largest special servicer in the market; and the second- and fifth-largest are Wells Fargo and KeyBank.

Notably, Wells Fargo is one of the two financial advisers Lennar hired to consider what to do with Rialto. The other adviser is Deutsche Bank.

The fourth-largest special servicer, CWCapital Asset Management, was acquired six months ago by Japanese multinational holding conglomerate SoftBank Group.

Distressed property purchasing is one of the country’s hottest investment categories and the primary target of new investment dollars. At a time when core property prices have hit new peaks, yield-hungry investors are aggressively sourcing new investment opportunities that offer more compelling returns.

Private equity funds raised $14.7 billion alone for value-add and opportunistic commercial real estate last quarter, according to private equity data provider Preqin.

About 75 percent of the new investment money being raised in the market is targeting value-add and opportunistic real estate, the categories that distressed assets fall into, said Chris Lee, vice chairman of CBRE Capital Markets Group based in Miami.

Lee directed one of the largest distressed deals of this year. CBRE, in conjunction with Ten-X, arranged the sale of a foreclosed upon leasehold interest in 110 E. Broward in Fort Lauderdale in January for $41.06 million. Stockbridge Capital Group acquired the 24-story office tower and an adjacent two-story office and retail pavilion. LNR Partners was the seller as special servicer for owner CMBS trust.

“There is no lack of demand for distressed properties,” Lee said of private equity firms. “There is a lot of hidden, and not so hidden, value in these properties.”

At the time of the sale, 110 E. Broward was only 42 percent leased at the time, representing a value-add opportunity by the lease-up of 198,803 square feet of vacant space in a market where the competitive set vacancy is just 8 percent.

In this environment, banks and servicers have had little trouble liquidating the distressed assets. So, the problem for Lee and other brokers is finding inventory right now to sell. The amount of distressed assets in the market at the moment is at post-2008 recession lows as the recovery is now approaching 10 years running.

The amount of foreclosed commercial properties on bank books had shrunk to just $4.7 billion in the first quarter from $31.2 billion seven years ago, according to Federal Deposit Insurance Corp. data.

The amount of specially serviced loans in commercial mortgage-backed securities has fallen by $70 billion in that time, down to about $23 billion.

The diverging trends of money coming in and assets available for liquidation has created a lot of jockeying among special servicers for the dwindling supply of deals. Wells Fargo Bank, PNC’s Midland Loan Services, Rialto Capital and KeyBank have grown their market share in the past two years at the expense of CWCapital Asset Management and other smaller servicers.

Of those loan balances assigned, the amount of distressed loans being actively serviced is small, about 2.4 percent. At year-end 2017, Rialto’s active special-servicing portfolio contained 364 loans and 481 real estate owned properties with a combined unpaid loan balance of $1.98 billion, according to Morningstar Credit Ratings.

In advance of any decision from Lennar about Rialto’s fate, the special servicer has also been particularly active in the past two months growing its special servicing assignments.

Another arm of Rialto has been one of the most active buyers of B-piece commercial mortgage bond offerings. That affiliate has underwritten and purchased over $6.1 billion in face value of such bonds in 88 different securitizations.

B-piece buyers generally purchase the lowest-rated and the very bottom of the bond classes — the unrated class. Any losses to the bond trust come out of the lowest-rated bonds first.

Because of that, B-piece buyers have the right to play an active role in making decisions on important issues that can affect the value of the loan or the collateral. That includes such issues as identifying what collateral goes into the offering and having first-purchase options on defaulted loans or, in this case, appointing new special servicers.

In the past two months, the Rialto affiliate has removed the existing special servicer on 11 different commercial mortgage bond offerings in which it has invested and replaced them with Rialto Capital, according to bond rating agency announcements. Rialto has taken assignments away from Midland Loan Services and CWCapital.

Such removal and replacing of special servicers is not unusual. CWCapital has also won such assignments in the past two months. However, the number of such switches involving Rialto has been much higher than for the others.

Executives from neither Rialto nor Lennar responded to requests for comments for this story.

Calco Commercial has recently sold both the 260 Shipley Street & 969 Folsom Street buildings. 260 Shipley Street is a two-story 3,750+/- square foot commercial building located in the SOMA with second floor office & ground floor warehouse. The property features skylights, private conference room, and a kitchenette in the office area and a drive-in roll-up entry for the warehouse.

969 Folsom Street is a 8,150+/- square foot commercial building located next door to 260 Shipley Street in the SOMA. 969 Folsom Street features 7,300+/- square feet of warehouse area with one drive-in loading door and 850+/- square feet of office with open and private areas and a kitchenette.

Calco Commercial specializes in the leasing and selling of commercial, office, industrial and NNN properties in and around San Francisco. If you have any questions about how to best re-position your asset in the Bay Area market, are a Tenant looking for space or have general market questions, call our office at 415.970.0000 and we can provide expert service.

With office vacancy rates looming shy of 5% in the South Financial District Submarket, Google has just leased approximately 57,000+/- square feet at 2 Harrison Street in the Hills Plaza. According to The San Francisco Chronicle, Google now occupies “400,000 square feet” at the Hills Plaza complex, with a total of “1 Million square feet of leased and owned” properties in San Francisco.

San Francisco office rents are currently averaging $61.51 per square foot according to Costar, and with tech giants like Google snapping up large swaths of office space, vacancy will continue to decrease, possibly forcing rents up for the rest of the office market.

Supervisors Aaron Peskin and Mayor Mark Farrell behind an ordinance that would allocate square footage from office space conversions back into the pool of space that can be developed for office. According to the San Francisco Chronicle, the ordinance would add approximately “1.3 million square feet” of potential office space under the cap.

In addition to adding some relief to the tight office market, the ordinance also hopes to green-light two “high-profile projects to move forward: Kilroy Realty’s Flower Mart, which will consist of 2 million square feet of offices on top of the flower vendors, and Tishman Speyer’s 598 Brannan St., which would include a 38,000-square-foot public park, 91 affordable housing units and 72,000 square feet of industrial space.”

Source: CoStar

By: Randyl Drummer

Link: Office Market 2020

Office completions are expected to peak this year and begin trending lower amid signs of a slowdown in U.S. office demand, a declining working-age population and an extended economic recovery entering the late stages.

That slowdown in construction is a good thing for office investors as it should keep supply in check and help extend the stable growth seen in office rents and sale prices.

Total office space under construction fell 7% in the first quarter of 2018 to 141 million square feet, down from 152 million square feet during the first quarter a year ago. The drop in construction occurred even as the national office occupancy rate continued to cruise in the first three months of the year at just under 90 percent, according to data presented at CoStar’s First-Quarter 2018 U.S. Office Review and Forecast.

“It’s been a remarkable cycle, especially lately, with very little movement in occupancy over the past year,” said CoStar Managing Consultant Paul Leonard, who presented the first-quarter office market analysis along with CoStar Portfolio Strategy Managing Director Hans Nordby.

With demand largely in check with supply in most metros, the national office market remains in a period of stability, Leonard said. While, annual rent growth has fallen well below the market peak of 5.6 percent, average office rents continue to increase at a healthy 2.1 percent clip.

“We’re expecting very little rise in vacancy over the next few years, maybe one or two tenths of a percentage point through 2019,” added Leonard. “That’s why we’re continuing to see good rent growth even though demand growth is beginning to slow.”

While new construction is trending lower, office deliveries are expected to peak in 2018 as several large build-to-suit projects, such as Apple’s mega campus in Cupertino, CA, reach completion. Office construction levels are expected to slow considerably in 2019 and 2020, Leonard added.

“Construction starts are down year-over-year and have been basically flat for two years,” Leonard said. “Uncertainty in the remaining length of the cycle, coupled with diminished rent growth, will give enough developers pause, slowing the supply trend overall.”

Despite the decrease in office construction activity, the level of speculative construction, which involves new development without a tenant commitment, is continuing to ramp up.

This is partly due to several high-profile built-to-suit projects reaching completion, resulting in a slow increase over the past year in the amount of space available for lease as a percentage of total office space under construction, Leonard said.

While the increase in speculative activity bears watching and certain markets, such as San Francisco, continue to see elevated office construction levels, the decline in new construction activity overall is good news for the market, Nordby said.

“The total amount of office space which is under construction is trending downward before the market hits the wall,” Nordby added.

Source: CoStar

By: Randyl Drummer

Link: Commercial Appraisals

Office of the Comptroller of the Currency, Constitution Center, Washington, D.C.

A new federal rule doubling the threshold for commercial real estate deals requiring an independent appraisal will reduce the time, cost and regulatory burden associated with processing smaller real estate deals, banking and real estate analysts say.

The Federal Reserve Board, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency adopted new rules exempting commercial property sales of $500,000 or less from the appraisal requirement. Regulators originally proposed raising the minimum from the current $250,000 to $400,000 but bumped it up to $500,000 after determining the higher threshold posed “no material loss risk to financial institutions.”

Under the new rule which used CoStar’s comparable sales data and repeat-sale indices to track pricing changes and other sales metrics over time, financial institutions must still perform a property evaluation for deals of $500,000 and below, but do not have to engage an independent appraiser.

“Deregulation is a major theme of the Trump Administration and this updated regulation is a smart move,” according to Justin Bakst, CoStar director of capital markets. “Moving the [sale] threshold up to $500,000 creates very little additional risk to the system,” he added.

Comps Data Used to Track Smaller Deals

In determining the level of increase, the agencies considered the change in prices for commercial properties measured by the Federal Reserve’s Commercial Real Estate Price Index (CRE Index). Since 2012, the CRE Index has been compiled using data from the CoStar Commercial Repeat Sale Index (CCRSI) as one of its data sources.

“The agencies examined data reported on the call report and data from the CoStar Comps database to estimate the volume of commercial real estate transactions covered by the existing threshold and increased thresholds,” according to the final rule.

Bakst said the agencies determined the small transactions affected by the new threshold, while large in number, did not create the type of leverage and risk that contributed to the last financial crisis. Banks have healthier capital ratios today and commercial real estate leverage has largely remained well under control, he added.

Banks can perform acceptable loan evaluations in house using sources of comparable sales data like CoStar, Bakst added.

“Although the property sales total affected by this rule change is a drop in the bucket compared with overall commercial property volume, the cost savings are noteworthy,” Bakst said. “For example, if we estimate appraisal costs at between $2,000 and $4,000 per transaction, this represents an aggregate savings of $300 million to $600 million.”

Banking regulators carved out an exception for construction loans on one- to four-family residential properties, which will no longer be included in the same category as commercial property loans to avoid potential confusion with single-family permanent financing and as an added consumer protection for home buyers. The sale threshold for appraisals on those properties will remain unchanged at $250,000.

Lower Threshold Was a 1990s Relic

Financial industry analysts who commented on the rule change said that the previous commercial transaction threshold had not kept pace with the price appreciation of commercial property.

For example, the average price of a property valued at $250,000 when regulators set the previous minimum threshold 24 years ago in 1994 has now more than tripled to $760,000. Raising the threshold to $500,000 provides a recession-resistant buffer, Bakst said.

Under the new $500,000 threshold, 31.9 percent of property sales in the CoStar database would be exempt from the appraisal requirement. In terms of dollar volume, however, the properties now exempt from appraisals comprise just 1.8% of the overall dollar volume of loans in the CoStar database.

Before the final rule was approved, there were 13 different categories of loan transactions that qualified for exemption from the appraisal requirement, including a general exemption for all real estate-related transactions with a value of $250,000 or less. The new rule adds a 14th exemption for “commercial real estate transactions” not secured by a single 1-to-4 family residential property.

“For commercial real estate transactions exempted from the appraisal requirement as a result of the revised threshold, regulated institutions must obtain an evaluation of the real property collateral that is consistent with safe and sound banking practices,” the new rule states.

Are Small Loans Risky for Small Banks?

Some critics, namely appraisers, take issue with the agency findings. James L. Murrett, president of the Chicago-based Appraisal Institute trade association representing nearly 19,000 appraisal professionals in about 60 countries, said raising the threshold is “confounding” given concerns expressed by the same agencies about commercial property pricing and loan risk management.

The OCC and Fed have warned that rapidly appreciating property prices in some commercial property segments and rising concentrations of commercial property loans, particularly among smaller banks with $1 billion to $10 billion in assets, could heighten risk to the nation’s banking system.

“Without a doubt, the final rule increases risk to the commercial real estate lending system,” Murrett said. “Seen through the lens of loosening regulations, the final rule may make sense. But from a safety and soundness perspective, the final rule raises significant concerns.”

Murrett said that an increase in property evaluations without appraisers will likely cause a return to the conditions during the run-up to the financial crisis, when “appraisal and risk management were thrust aside to make more, not better, loans.”

Smaller institutions, which are less likely to maintain appraisal departments, are more likely to be susceptible to breakdowns in appraisal independence with fewer controls in place, he added.

Murrett said the decision increases the importance of modernizing the regulatory structure governing appraisals, including positioning appraisers to better offer evaluation services.

“Appraisers need to be nimbler in today’s marketplace – not only to compete, but to help maintain safety and soundness of the real estate financial system.”

Big Shops Don’t Play in Small Loan Pools

Appraisal operations in the largest commercial real estate services companies likely won’t be affected by the rule change since , their main business is more sophisticated and generally involves providing so-called broker opinions of value for complex property assets priced above $500,000, said John Busi, president of the valuation and advisory group at Newmark Knight Frank.

The appraisal world is getting faster and cheaper and this change creates efficiency for the banking regulators to be a little more nimble and relax some of the standards put in place after the financial crisis,” Busi said.

“Of course appraisers are going to be upset by it because many have had business on commercial property under $500,000,” said Busi. But he added that smaller appraisal shops should be nimble enough to adapt and bring in work without suffering a large decline in fees.

“We view the recent increases in thresholds for appraisal requirements as an opportunity for lenders, borrowers, and appraisers,” added Chris Roach, CEO with BBG, one of the nation’s largest pure-play valuation and appraisal companies with 27 U.S. offices.

Roach said BBG’s valuation specialists have evolved from a traditional appraisal practice to a more diverse valuation practice for a variety of clients.

“We stand by our high-quality valuation products, no matter the size of the loan,” Roach said. “But with these revised loan amount guidelines, we are well-positioned for growth in our evaluation product.”

Source: CoStar

By: Randyl Drummer

Link: Warehouses

Warehouse giant Prologis Inc. is ramping up construction and asset sales following healthy first-quarter results powered by brisk leasing and near-double-digit rent growth in the red-hot logistics market.

Based on robust demand for modern logistics space by e-commerce and other tenants, San Francisco-based Prologis this week raised the value of planned development starts by $200 million to between $2.2 billion and $2.5 billion for 2018. Roughly half the new activity is lower-risk build-to-suit construction, Prologis Chief Financial Officer Tom Olinger told investors.

Prologis (NYSE: PLD), by tradition one of the first equity REITs to report earnings each quarter, also increased its estimate of projected building and land sales by roughly $475 million to between $1.4 billion and $1.7 billion for the year. The sell off will effectively complete the company’s seven-year campaign to dispose of assets deemed “non-strategy” following Prologis’s 2011 merger with AMB Property Corp.

“Market conditions remain extremely healthy and our strategy is set,” Prologis Chairman and CEO Hamid R. Moghadam told investors. “Going forward, it’s all about execution.”

One stock analyst summed it up even more succinctly following the earnings presentation by Prologis, a quarterly bellwether for U.S. and global logistics markets: “Industrial has never been this good.”

John W. Guinee, analyst with Stifel, Nicolaus & Associates, said Prologis’s extraordinary 9.2% first-quarter rent growth, steady demand from Amazon and other tenants and strong development platform “sets the stage for a strong 2018 and 2019.”

Prologis, fueled by the strong earnings report, led all equity REITs with a 4.3% increase in its share price on Wednesday. Industrial REITs again led all property sectors with 1.8% average growth, with Prologis rivals Rexford Industrial Realty, Inc. (NYSE: REXR) and Terrano Realty (NYSE: TRNO) turning up among the top five gaining REIT stocks.

Only a handful of factors could derail the world’s largest industrial REIT from another strong year, including the prospect of a long trade war between the U.S. and China, which could hurt Prologis and its industrial REIT rivals along with the rest of the economy.

“Any kind of trade war is bad for economic growth generally,” Moghadam said in response to an analyst’s question. “If the economy grows at 30 to 40 basis points slower than it would have otherwise, that’s not good for anybody’s business.”

The good news is that talks, including President Donald Trump’s expressed interest in possibly rejoining the Trans-Pacific Partnership (TPP) trade agreement, are still in their early stages while announced new tariffs have not yet fully gone into effect, Moghadam said.

“All of our customers that I’m aware of, basically, have their head down doing business, and they’re not paying too much attention to what comes out in the tweets in the morning until there is something specific they can react to,” Moghadam said.

The CEO pointed out that most of the tariffs announced to date have been imposed on raw or intermediate materials, which does not affect Prologis’s main logistics and warehouse business.

“Steel doesn’t go through warehouses, aluminum doesn’t go through warehouses. The simplest way of thinking about it is that while we are concerned by the talk; we are not yet concerned by the action,” Moghadam added.

That said, Prologis is carefully monitoring rising construction costs which some analysts have said could be exacerbated by tariff-related increases in materials prices. In the San Francisco Bay Area, for example, costs are up 20% to 25% over last year, Moghadam said.

“[Construction costs] have been stable for many years and now it’s time for the contractors and buyers to make some hay while the sun is shining,” Moghadam said. “But it’s getting tougher to pencil out spec development in some of these markets, and that’s good news I guess for rental growth over time.”

New tariffs and trade disputes are casting a pall over sentiments across various sectors, even as all 12 regions of the Federal Reserve Bank reported continued robust job growth with few signs of overheating, according to the Beige Book, the Fed’s most recent survey of U.S. businesses.