Click here for the full report: Q1 2018 Industrial

Click here for the full report: Q1 2018 Industrial

Source: CoStar

By: CoStar Research

For its fifth year in a row, Calco Commercial has been named as one of San Francisco’s Top Leasing Firms by CoStar, with Scott Mason also being listed at a Top Industrial Broker. Calco Commercial leased or sold a total of 415,000+/- square feet of industrial, flex and commercial spaces representing nearly 60 transactions in 2017. Calco is a leading industrial and commercial real estate firm with decades of experience in Landlord/Owner representation, Tenant Requirements, Property Management and converting assets into net leased investment properties.

Every year, CoStar’s research team verifies and records the commercial real estate sales and lease transactions that closed during the previous year. From that information, CoStar presents CoStar Power Broker Awards to a select number of brokerage firms and individual brokers who closed the highest overall transaction volumes in commercial property sales and leases within their respective markets. Now in its 17th year, the awards recognize those who perform at the highest levels in commercial real estate brokerage.

Source: the Registry

By: Vladimir Bosanac

Date Posted: March 28, 2018

Link to Article: GOOGLE

San Francisco continues to be a magnet for tech companies small and large. While making strides in acquiring buildings and land across Silicon Valley, Google is also making sure its presence in the city continues to build upon an established base that will keep the talent flowing and projects moving along. According to a recent report by CoStar, Google has expanded its footprint in San Francisco at its 2 Harrison Street location, signing on to take additional 57,000 square feet in the building.

The space that Google is taking over is currently occupied by Gensler, the international and world-renown architecture firm, which will be vacating the building shortly.

The building has been home to Google for some time, and with this expansion, the technology giant will occupy around 125,000 square feet in the property. The property, also known as Hills Plaza, was once home to Hills Bros. Coffee, where the company’s coffee plant was once located. It was built in 1924 and later renovated in 1986. Today it has 211,000 square feet, and Google’s latest lease would put it over half of building.

Other tenants in the building are Mozilla (the makers of the Firefox web browser), Marin Day School, the Wharton School (University of Pennsylvania) and the offices of the owner, Prime Property Fund, which is a Morgan Stanley core property fund.

The building is located along the Embarcadero, and it sits almost at the foot of the Bay Bridge with views of the bay, Treasure Island and Oakland. The building is also home to Palomino restaurant, which is located on the ground floor.

Google has been in the news almost weekly in the last few months. Along with negotiating a massive development in San Jose next to the city’s Diridon Station, the company has continued its buying spree across the region and especially so in Silicon Valley. In February, the company received an approval from the city of San Jose to purchase land that was previously owned by the city for $67 million. Just a month earlier, it spent $117.25 million on three industrial buildings also in San Jose. In Sunnyvale, along with spending around $250 million in the fourth quarter of 2017 to buy land and properties, it also proposed a new, one-million-square-foot campus that would house 4,500 employees.

Source: CoStar

By: Randyl Drummer

Date Posted: March 22, 2018

Link to Article: Interest Rate Hike

In a widely expected but still worrisome move for commercial real estate investors and financial markets, the Federal Reserve Bank on Wednesday raised the federal funds rate a quarter point from 1.5% to 1.75%, the first of three rate hikes expected by the central bank and the sixth quarter-point increase since the beginning of 2016.

The Fed, in its first policy meeting under new Chairman Jerome Powell, also raised the longer-term “neutral” rate, the level at which monetary policy neither boosts nor slows the economy. In a news conference Wednesday, Powell said that the economy has recently gained momentum and he expects inflation to finally move higher after years running below its 2% historical target.

The Federal Open Markets Committee noted in a statement at the end of its two-day meeting that the labor market has continued to strengthen and that economic activity has been rising at a moderate rate.

The FOMC noted strong job gains in recent months and the exceptionally low unemployment rate, underscoring the central bank’s growing confidence that tax cuts and government spending will continue to boost the economy. Unemployment is now expected to fall to 3.8% this year and 3.6% in 2019, which would be the lowest since 1969.

While the Fed plans to follow a path of gradual rate increases, Powell said policymakers need to be cautious about inflation. The chairman warned that financial market asset prices, including real estate, are high relative to their longer-run historical norms in some areas.

“You can think of some equity prices. You can think of commercial real estate prices in certain markets. But we don’t see it in housing, which is key,” Powell said.

“Overall, if you put all of that into a pie, what you have is moderate vulnerabilities in our view,” the chairman added.

In their Monetary Policy Report to Congress last month, Fed policymakers noted “valuation pressures continue to be elevated across a range of asset classes, including equities and commercial real estate. In general, valuations are higher than would be expected based solely on the current level of longer-term Treasury yields,” the report said.

Although rates remain low by historical standards, interest rate increases remain top of mind for CRE executives this year. In a sentiment survey by law firm Seyfarth Shaw, 80% of respondents expected multiple rate increases, and clearly expect that the increases will begin to weigh on commercial property markets in 2018.

More than one-third, 37%, of those surveyed in February by the Chicago-based firm predicted three rate hikes by the Fed over the next 12 months, up from just 14% a year ago.

CoStar Portfolio Strategy Managing Director Hans Nordby notes that the end of the so-called low-rate environment is going to have an increasing impact on CRE pricing going forward.

While interest rates are going to matter much more to investors, and will likely lead to higher cap rates, Nordby expects only about one-half to two-thirds of the 10-year Treasury rate yield should transfer to cap rates because the spreads between cap rates and Treasury rates are already wide compared to historical levels.

“CRE investors have worried about cap rate increases for the better part of 15 years, and fighting the Fed with the assumption of higher rates has served few well. Those who avoided low-cap-rate deals and bought the best assets have fared very well since the Great Recession,” Nordby said.

“However, those who bought at higher cap rates but took on credit or market risks, such as acquiring Toys ‘R Us stores in sleepy suburbs or less-thriving U.S. cities, those bets probably didn’t fare so well,” Nordby added.

“But today’s (rate increase) is a little different,” Nordby added. “The Fed appears to be on board with higher rates at both the short and long ends of the (yield) curve. Fighting the Fed now means trying to hang on to scary-low cap rates in some of the nation’s largest markets.”

Nordby also points out that many properties may have lower cap rates because their existing leases are at below-market rents, which presumably will be replaced with higher-income leases as they roll over.

However, while many assets have the potential to benefit from this dynamic, properties that are locked into a 20-year lease with a credit tenant that was previously touted for its bond-like stability when interest rates were low may see value decline as interest rates rise, Nordby said.

“Markets like New York City multifamily, which had razor-skinny cap rates and spreads, are now showing weak or negative rent growth. These are the types of assets that are most exposed to interest rate surprises in the next couple years,” Nordby said.

The boom of e-commerce, fueled by Amazon, as created a demand for industrial warehouse space across the nation. But how long can the industrial boom be sustained–can other companies follow the “same day delivery” demands sparked by Amazon, and how will increasing construction costs affect the market? At Bisnow’s National Industrial event in New York, such questions were discussed.

Click here to read the responses including how a lack of truck drivers, old ports, and lack of space may impact the industrial marketplace: Industrial Boom

With the ever present shift of brick & mortar retail to e-commerce, the recently completed 350K square foot “retail center” located at 945 Market Street may also undergoing a shift of its own. According to SocketSite, the developer Cypress Equities, “is now seeking approval to convert 47,522 square feet of the five-story building’s retail space into open floor office space.”

The San Francisco Planning Commission is scheduled to hear the proposed conversion pitch by mid-March 2018. What will become of the remaining vacant 217,000 square feet remains to be seen.

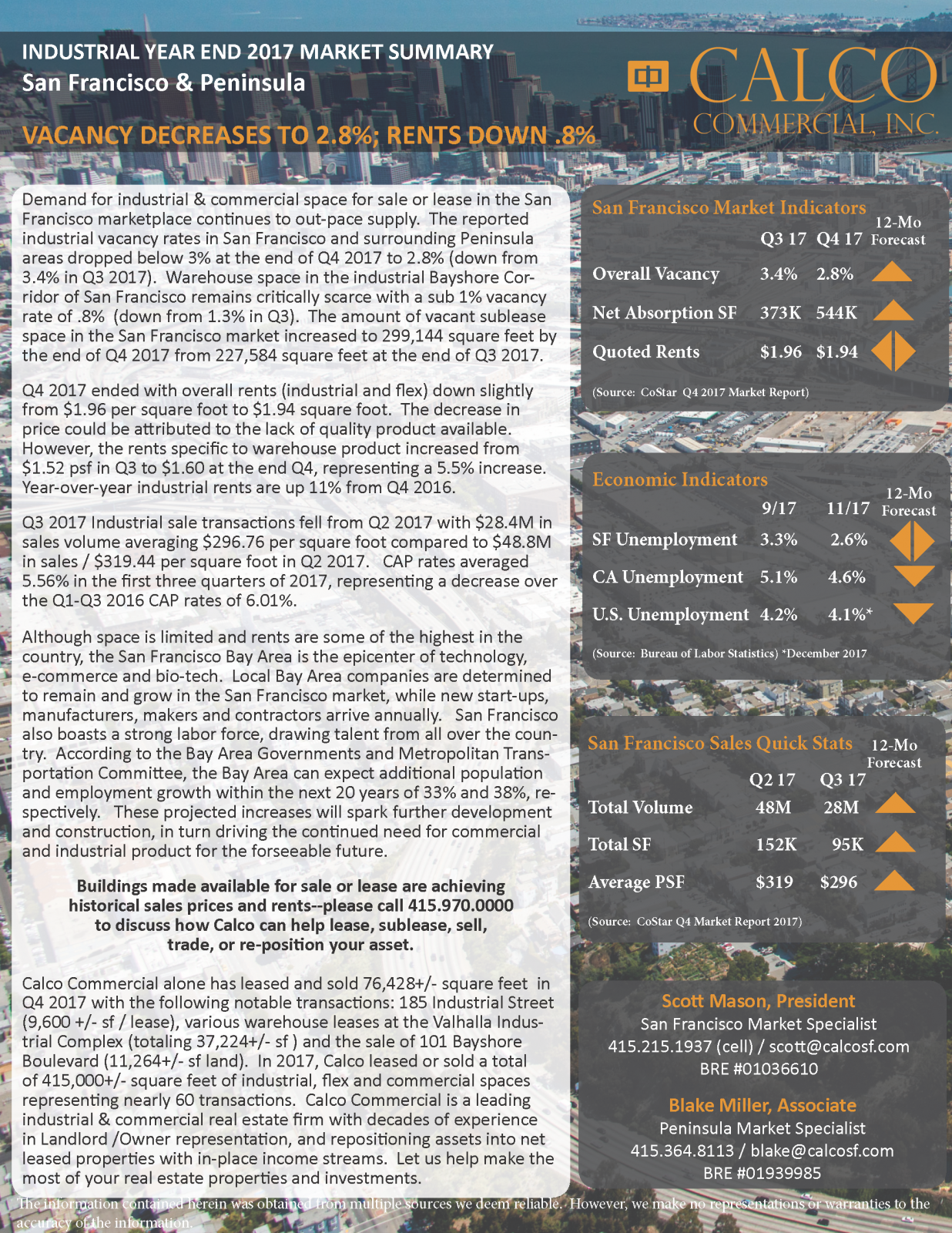

Click here for the full report: Q4 2017 Industrial Market Report

According to Bisnow, the 2018 commercial real estate market for San Francisco is expected to be positive. From industrial to residential, all SF product types are still in an up-swing. Per the article, even with a possible recession looming in the next few years, industry experts believe it could be a less than 2% of GDP, while the 2008 recession was 4.1%, for comparison.

Developers too, are positive about where San Francisco CRE is headed in 2018 with the demand for housing, office, bio-tech and industrial still holding strong. With high profile and large re-development projects under way such as the 850K square feet of office at the previous San Francisco Tennis Club and the 5M square feet of office at the Shipyard/Candlestick site, San Francisco will have the product to entice future businesses to re-locate and give local companies the opportunity to expand.

2017 is proving to be a banner year for large tech real estate transactions. From Facebook to Okta, “Bay Area tech companies are determined to grow in the city–whatever the cost.” And according to the San Francisco Chronicle, that cost is sky-rocketing. The Chronicle states that tech rents have increased “140 percent since 2010…and could go up another 10%.”

San Francisco continues to be the epicenter for tech and draws talent from all over the country–and that influx of workers to San Francisco is “not expected to slow.” Employment rates have always been associated with the health of the commercial real estate market. With workers tech workers streaming into the Bay, long established tech giants expanding and new start-ups popping up every year, office and flex space will continue to remain in high demand.

Click here for the full report: Q3 2017 SF Market Report