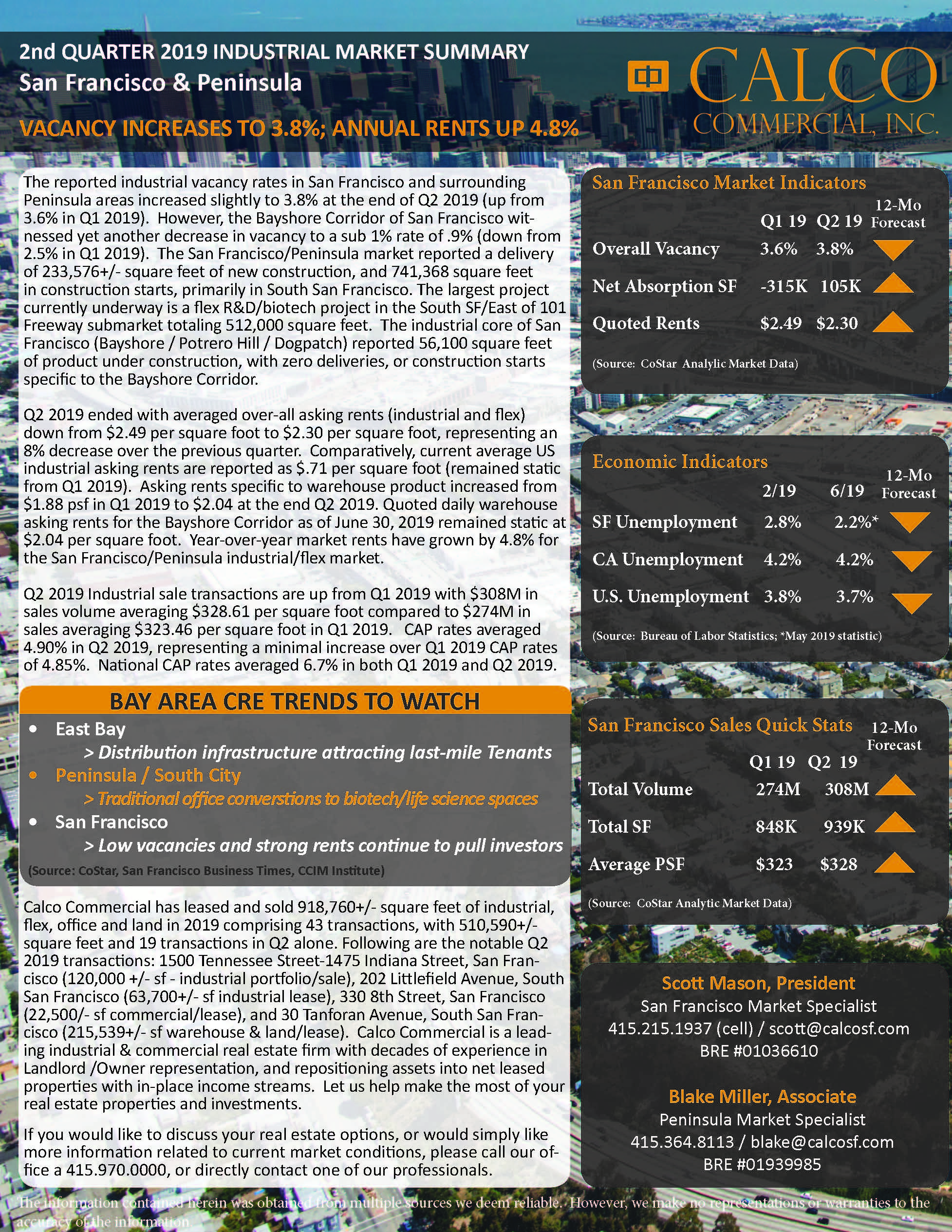

Per the Costar Group, Property Sellers are in the “best postition in 15 years” to acheiving desired asking prices. Demand for investment/income-prodcuing real estate is outpacing supply, which is contributing to the strong selling prices coupled with quick closes. Due to remote workers relocating to less expensive suburbs, secondary and tertiary markets are seeing record level price growth as well.