Achaogen, an antibacterial drug developer, has found new digs at the Genesis tower in South San Francisco. According to the San Francisco Business Times, Achaogen leased 47,000+ square feet comprised of the “entire third floor and part of the fourth floor,” all while scoring a “$5.6 million” tenant improvement package.

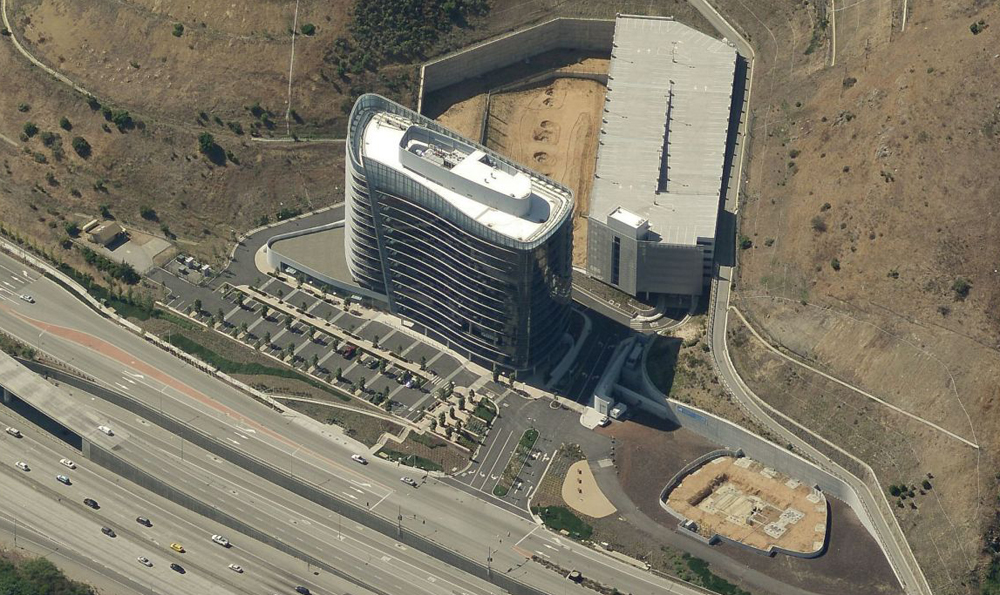

Genesis-South San Francisco

The Genesis building, formerly known as “Centennial Towers”, has historically been marketed as high-end office space and has experienced long swaths of vacancies. But, given the high demand for biotech/lab space, Phase 3 Real Estate Partners coverted the building from office to research and development as reported by the San Francisco Business Times earlier this year.

Achaogen is expected to employ over 200 employees at the site with other biotech companies expected to join the tenant roster early next year, according to the article. Phase 3 also intends to complete a “neighboring 21-story tower” in 2018.