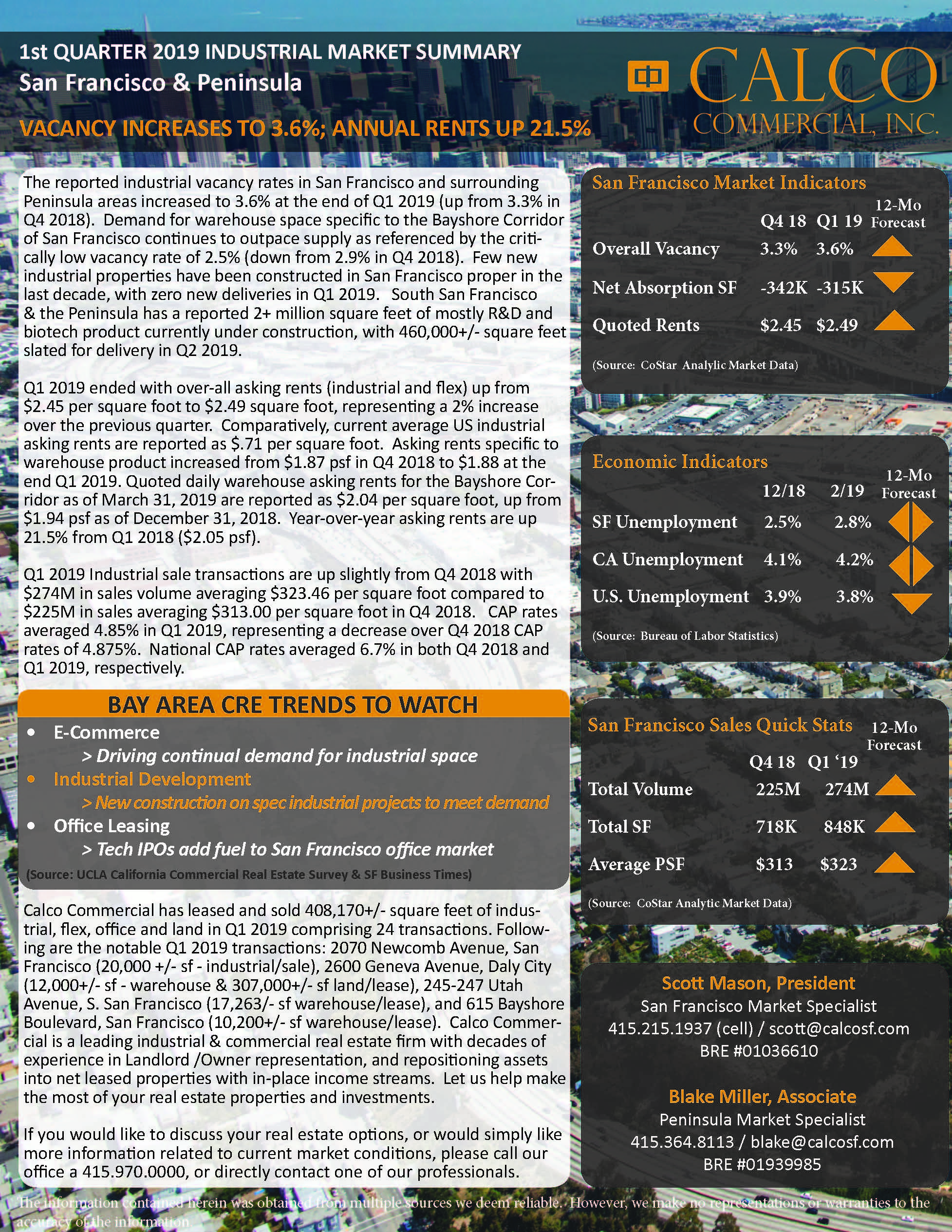

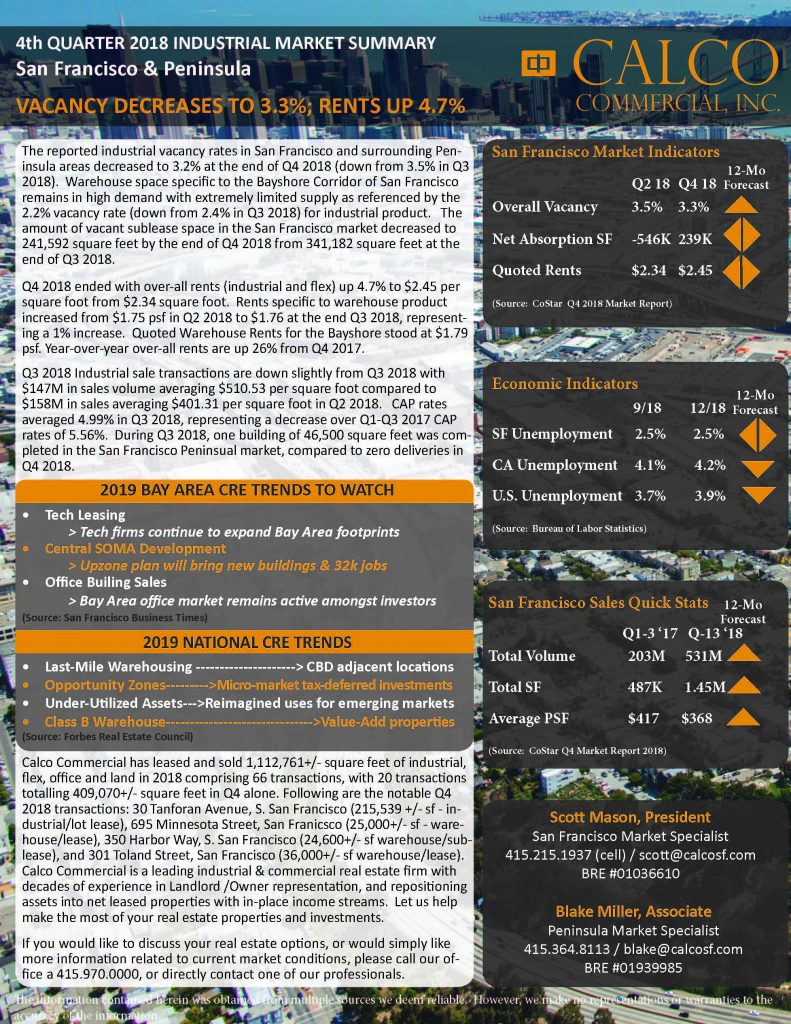

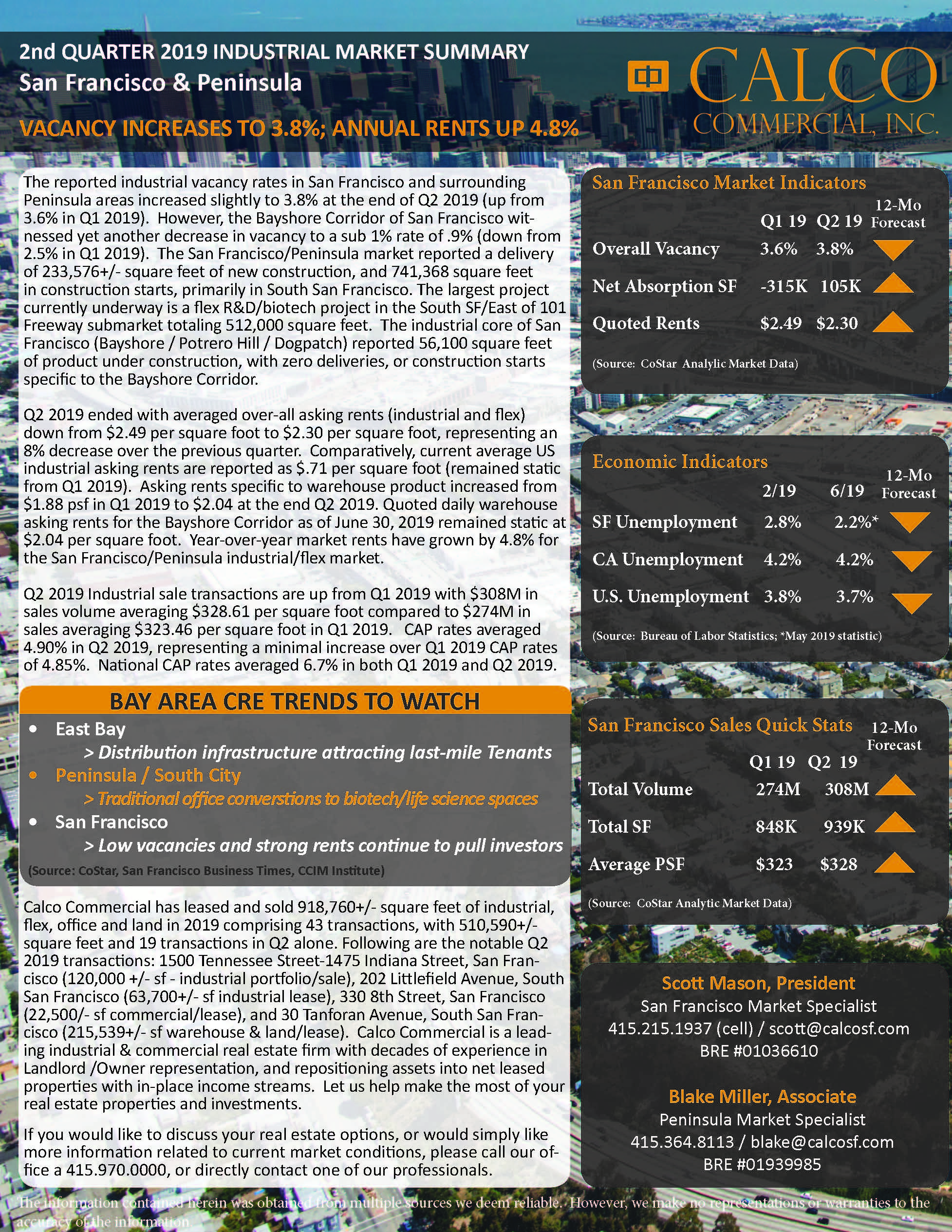

The reported industrial vacancy rates in San Francisco and surrounding Peninsula areas increased slightly to 3.8% at the end of Q2 2019 (up from 3.6% in Q1 2019). However, the Bayshore Corridor of San Francisco witnessed yet another decrease in vacancy to a sub 1% rate of .9% (down from 2.5% in Q1 2019). The San Francisco/Peninsula market reported a delivery of 233,576+/- square feet of new construction, and 741,368 square feet in construction starts, primarily in South San Francisco. The largest project currently underway is a flex R&D/biotech project in the South SF/East of 101 Freeway submarket totaling 512,000 square feet. The industrial core of San Francisco (Bayshore / Potrero Hill / Dogpatch) reported 56,100 square feet of product under construction, with zero deliveries, or construction starts specific to the Bayshore Corridor.

Q2 2019 ended with averaged over-all asking rents (industrial and flex) down from $2.49 per square foot to $2.30 per square foot, representing an 8% decrease over the previous quarter. Comparatively, current average US industrial asking rents are reported as $.71 per square foot (remained static from Q1 2019). Asking rents specific to warehouse product increased from $1.88 psf in Q1 2019 to $2.04 at the end Q2 2019. Quoted daily warehouse asking rents for the Bayshore Corridor as of June 30, 2019 remained static at $2.04 per square foot. Year-over-year market rents have grown by 4.8% for the San Francisco/Peninsula industrial/flex market.

Q2 2019 Industrial sale transactions are up from Q1 2019 with $308M in sales volume averaging $328.61 per square foot compared to $274M in sales averaging $323.46 per square foot in Q1 2019. CAP rates averaged 4.90% in Q2 2019, representing a minimal increase over Q1 2019 CAP rates of 4.85%. National CAP rates averaged 6.7% in both Q1 2019 and Q2 2019.

Calco Commercial has leased and sold 918,760+/- square feet of industrial, flex, office and land in 2019 comprising 43 transactions, with 510,590+/- square feet and 19 transactions in Q2 alone. Following are the notable Q2 2019 transactions: 1500 Tennessee Street-1475 Indiana Street, San Francisco (120,000 +/- sf – industrial portfolio/sale), 202 Littlefield Avenue, South San Francisco (63,700+/- sf industrial lease), 330 8th Street, San Francisco (22,500/- sf commercial/lease), and 30 Tanforan Avenue, South San Francisco (215,539+/- sf warehouse & land/lease). Calco Commercial is a leading industrial & commercial real estate firm with decades of experience in Landlord /Owner representation, and repositioning assets into net leased properties with in-place income streams. Let us help make the most of your real estate properties and investments.

If you would like to discuss your real estate options, or would simply like more information related to current market conditions, please call our office a 415.970.0000, or directly contact one of our professionals.

Click here for the full report: Q2 2019 Industrial Market Report – San Francisco & Peninsula